[Full disclosure: this blogger worked on Google Wallet 2011-2013]

This blogger recently upgraded to Android Pay, one half of the mobile wallet offering from Google. The existing Google Wallet application retains functionality for peer-to-peer payments, while NFC payments are moved to the new Android Pay. At least that is the theory. In this case NFC tap-and-pay stopped working altogether. More interestingly, trying add cards from scratch showed that was not just a routine bug or testing oversight. It was a deliberate shift in product design: the new version is no longer relying on “virtual cards” but instead integrates directly with card issuers. That means all cards are not created equal; only some banks are supported. (Although there may have been an ordinary bug too— according to Android Police, there is supposed to be an exception made for existing cards already used for NFC payments.)

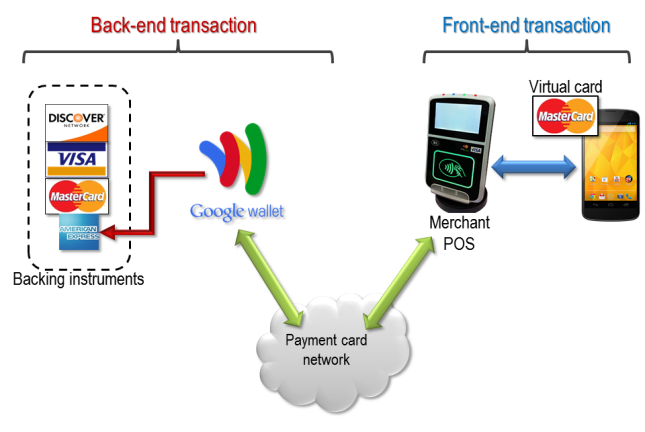

Let’s revisit the economic aspects of the virtual-card model and outline why this shift was inevitable. Earlier blogs posts covered the technical aspects of virtual cards and how they are used by Google Wallet. To summarize, starting in 2012 Google Wallet did not in fact use the original credit-card when making payments. Instead a virtual-card issued by Google** is provisioned to the phone for use in all NFC transactions. That card is “virtual” in two senses. First it is an entirely digital payment option; there is no plastic version that can be used for swipe transactions. (There is a separate plastic card associated with Google Wallet; confusingly that card does not have NFC and follows a different funding model.) Less obvious, consumers do not have to fill out an application or pass a credit-history check to get the virtual card; in fact, it never shows up in their credit history. At the same time that card is very “real” in the sense of being a full-fledged MasterCard with 16 digit card number, expiration date and all the other attributes that make up a standard plastic card.

When the virtual card is used at some brick-and-mortar retailer for a purchase, the point-of-sale terminal tries to authorize the charge as it would for any other vanilla card. By virtue of how transactions are routed on payment networks such as Visa/MasterCard, that charge is eventually routed to the “issuing bank”— which happens to be Google. In effect the network is asking the issuer: “Can this card be used to authorize pay $21.55 to merchant Acme?” This is where the real-time proxying occurs. Before answering that question from the merchant, Google first attempts to place a charge for the same amount on one of the credit-cards supplied ahead of time by that Google Wallet user. Authorization for the virtual-card transaction is granted only if the corresponding charge for the backing instrument goes through.

(Interesting enough, that design makes NFC virtual card a prepaid card on steroids. Typically a prepaid-card is loaded ahead of time with funds and that balance later gets withdrawn down to pay for a purchase. Virtual card is doing the same thing on a highly compressed timeline: the card is “funded” by charging the backing credit-card and exact same balance is withdrawn to pay the merchant. The difference: it happens in a matter of seconds in order to stay under the latency requirements of payment networks.)

Why proxy?

So why all this complexity? Because it allows supporting any card without additional work required by the issuer. Recall that setting up a mobile NFC wallet requires provisioning a “payment instrument” capable of NFC transactions to that device. That is not just a matter of recording a bunch of details such as card number and CVV code once. Contactless payments use complex protocols involving cryptographic keys that generate unique authorization codes for each transaction. (This is what makes them more resistant to fraud involving compromised point-of-sale terminals, as in the case of Target and Home Depot breaches.) Those secret keys are only known to the issuing bank and can not be just read off the card-face by the consumer. That means provisioning a Citibank NFC card requires the mobile wallet to integrate with Citibank. That is how the original Google Wallet app worked back in 2011.

The problem is that such integrations do not scale easily, especially when there is a hardware secure element in the picture. There is a tricky three-way dance between the issuing bank who controls the card, mobile-wallet provider that authors the software on the phone and trusted service manager (TSM) tasked with managing over-the-air installation of applications on a family of secure elements. Very little about the issuer side is standardized, meaning that proliferating issuers also means a proliferation in the number of one-off integrations required to support each card.

Virtual cards cleanly solve that problem. Instead of having to integrate against incompatible provisioning systems from multiple banks, there is exactly one type of card provisioned to the phone. Integration with existing payment networks is instead relegated to the cloud, where ordinary online charges are placed against a backing instrument.

Proxy model: the downsides

While interesting from a technical perspective and addressing one of the more pressing obstacles to NFC adoption— namely users stymied by their particular financial institution not being supported— there are also clear downsides to this design.

Economics

As industry observers were quick to point out soon after launch, the proxy model is not economically viable at scale. Revisiting the picture above, there is a pair of transactions:

- Merchant places a charge against a virtual card

- Issuer of the virtual card places a charge for the identical amount against the consumer’s credit card

Both are going through credit-card networks. By virtue of how these network operate, each one incurs a fee, which is divvied up among various parties along the way. While the exact distribution varies based on network as well bargaining positions of issuer/acquirer banks, an issuing acquiring bank typically receives the lion’s share but less than 100%. For the above transactions, the provider of the virtual card is acting as issuer for #1 and merchant for #2. Google can expect to collect fees from the fronting instrument transaction while paying a fee for the backing charge.

In fact the situation is worse due to the different transaction types. The second charge is card-not-present or CNP, the same way online purchases are done by typing card numbers into a webpage. Due to increased risk of fraud, CNP transactions carry higher fees than in-store purchases where the customer presents a physical card and signs a receipt. So even if one could recoup 100% of the fee from the fronting instrument, that would typically not cover the cost of backing transaction. (In reality, the fees are not fixed; variables such as card type can greatly complicate the equation. For example, while the fronting instrument is always a MasterCard, the backing instrument could be an American Express which typically boasts some of the highest fees, putting the service deeper into the red.)

Concentrating risk

The other problem stems from in-store and CNP modes having different consequences in the event of disputed transactions. Suppose the card-holder alleges fraud or otherwise objects to a charge. For in store transactions with a signed receipt, the benefit of the doubt usually goes to the merchant, and the issuing bank is left eating the loss. For card-not present transactions where merchants can only perform minimal verification of card-holder, the opposite holds: process favors the consumer and the merchant is left holding the bag. Looking at the proxy model:

- Google is the card issuer for an in-store purchase

- Google is the merchant of record for the online, card-not-present charge against the backing instrument

In other words, the model also concentrates fraud risk with the party in the middle.

Great for users, bad for business?

In retrospect the virtual-card model was a great boon for consumers. From the user perspective:

- You can make NFC payments with a credit card from any bank, even if your bank is more likely to associate NFC with football

- You can use your preferred card, even at merchants who claim to not accept it. A merchant may not honor American Express but the magic of virtual cards has a MasterCard channeling for that AmEx. Meanwhile the merchant has no reason to complain because they are still paying ordinary commissions and not the higher AmEx fee structure.

- You continue earning rewards from your credit-card. In fact that applies to even category-specific rewards, thanks to another under-appreciated feature of the proxy model. Some rewards programs are specific to merchant types, such as getting 2x cash-back only when buying gas. To retain that behavior, the proxy model can use different merchant-category code (MCC) during each backing charge. When the virtual card is used to pay at a gas station, Google can relay the appropriate MCC for the backing transaction.

From a strategic perspective, these subsidies can be lumped in with customer-acquisition costs, similar to Google Wallet initially offering a free $10 when it initially launched or Google Checkout doing the same a few years back. Did picking up the tab for three years succeed in boot-strapping an NFC ecosystem? Here the verdict is mixed. Virtual cards successfully addressed one of the major pain-points with early mobile wallets: limited selection of supported banks. Unfortunately there was an even bigger adoption blocker for Google Wallet: limited selection of wireless carriers. Because Verizon, AT&T and T-Mobile had cast their lot with the competing (and now failed) ISIS mobile wallet, these carriers actively blocked alternative NFC solutions on their devices. The investment in virtual cards had limited dividends because of a larger reluctance to confront wireless carriers. It’s instructive that Apple pursued a different approach, painstakingly working to get issuers on-board to cover a large percentage of cards on the market—but decidedly less than the 100% coverage achievable with virtual cards.

CP

** More precisely issued by Bancorp under contractual agreement with Google.